Tax and Compliance

What We Do

The Tax Department ensures that Rutgers complies with a variety of federal and state tax laws and regulations. We strive to provide the highest quality advice and service on a wide range of tax issues.

Sales and Use Tax Guidelines

Learn about the state of New Jersey’s requirements for sales and use tax and relevant university exemptions.

Determining Worker Status

Review the factors that justify an individual’s status as an employee or an independent contractor.

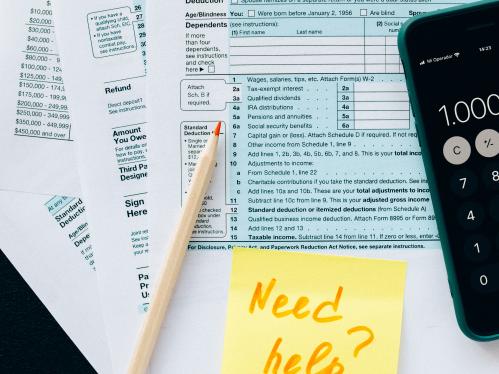

Miscellaneous Payments

Learn how miscellaneous payments are defined and the corresponding withholding levels for U.S. citizens and resident aliens.